At a glance

With the All-In-OneTM Home Equity line of credit, clients can finance the purchase of their home, renew their mortgage or refinance. This solution allows clients to use as much or as little of the available credit as needed, eliminating the need to apply for new financing for large purchases, home renovations, investment contributions or education financing.

Ideal for clients who’d like to:

- Find a solution to consolidate their loans and save on interest

- Increase their assets

- Simplify their banking operations and the management of their accounts

- Have more flexibility in managing their financial needs

Go beyond your clients’ needs

More flexibility

Your clients’ minimum monthly payments include only interest and insurance premiums (if applicable). Managing their cashflow is up to them and they can adjust their payment amounts as necessary. They have the flexibility to use what they need and repay the loan in whole or in part, at any time and without penalty.

More tax deductibility

Your clients can open several distinct transactional accounts with the All-In-OneTM credit line. If an account is used for investments, they can isolate and deduct interest.

More possibilities

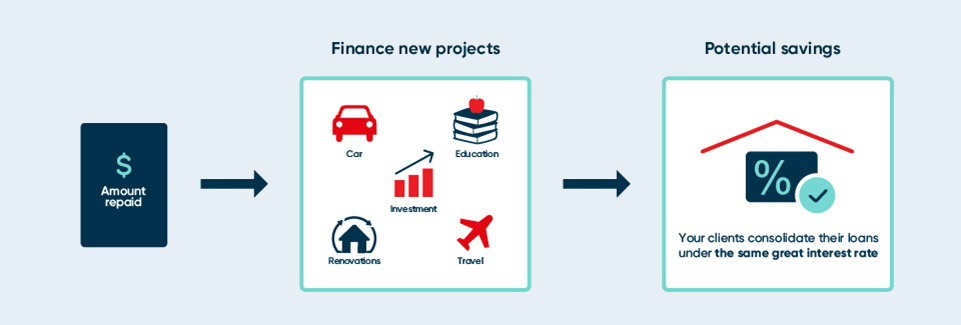

Clients can use as much or as little of the repaid principal as needed without applying for a new credit loan, freeing up cash flow for future investments or projects.

A line of credit for all your mortgage needs

Two versions of the AIO |

|||

|---|---|---|---|

Line of credit only |

Made-to-measure mortgage (loan AND line of credit) |

Mortgage loan |

|

| What is it? | You can access your repaid principal to pay for other projects. |

Use the line of credit portion to finance up to 65% of the value of the property. You can access your repaid principal. Given a 20% down payment and a line of credit that covers 65% of the purchase price, the loan portion finances the remaining 15%. You can't access this portion of your repaid principal. |

A traditional loan, which must be repaid over a given term. You can't access your repaid principal. |

| Down payment | More than 35% of the property's value. |

More than 20%. |

More than 5%. |

| Perfect if you're looking to: |

Get financing or refinancing equivalent to 65% of the property's value. |

Enjoy flexible financing together with the security of a traditional loan. |

Benefit from the peace of mind of knowing your payment schedule in advance. |

| Rate See all rates |

${p5.taux|percent:"true"} variable Fee of $7 per month per account. |

Line of credit portion: Fee of $7 per month per account. For the loan portion, choose a fixed rate, a variable rate, or a combination of the two. |

Choose a fixed rate, a variable rate, or a combination of the two. |

| Payments |

Decide your payment amount and frequency. Only interest and insurance, if applicable, must be paid. |

Line of credit portion: decide your payment amount and frequency. Only interest and insurance, if applicable, must be paid. For the loan portion, payments must be made as set out in the loan agreement. |

Payments must be made as set out in the loan agreement. |

| Access to funds |

Your repaid principal automatically becomes available—online, at the ABM, via debit card, etc. |

For the line of credit portion, your repaid principal automatically becomes available—online, at the ABM, via debit card, etc. |

To access funds, you'll need to apply for refinancing. |

| Additional payments |

No prepayment charge. |

No prepayment charge on the line of credit portion. Loan portion: accelerated repayment possible under certain conditions. |

Accelerated repayment possible under certain conditions. |

How it works?

Purchase or refinancing: Up to 65% of the value of the property.

Possibility of financing up to 80% of the value of the property if combined with a mortgage loan.

Your tools

Download our tool designed to discover the All-In-OneTM Home Equity line of credit with your clients. Compare it with a standard mortgage.

Download the document

Ready to refer a client?

Check out our easy online referral process.

1-800-901-0172

Monday to Friday

8 a.m. to 8 p.m. ET